30+ self employed mortgage lender

Web Lenders define a self-employed borrower as anyone who receives more than 25 percent of their income in non-salaried pay. The majority of Lenders use and average of your latest 2 years accounts and this could be fine for what you need to borrow.

Self Employed Mortgages Guide Moneysupermarket

Comparisons Trusted Low Interest Rates.

. Web 30 to 40 days for purchase closings although the lender can accommodate shorter timeframes if needed. Check Your Eligibility for a Low Down Payment FHA Loan. Web How lenders assess Self Employed.

The Search For The Best Mortgage Lender Ends Today. Web Mortgage loans for the self-employed work differently than those who work for someone. The mortgage process is very well known for involving a lot of paperwork.

Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says. VA Loan Expertise and Personal Service. The Best Offers from BBB A Accredited Companies for self employed.

Relevance - date 291 jobs Mortgage Broker Smart Choice. Ad First Time Home Buyers. Get Your Quote Today.

Web Lenders usually offer a self-employed mortgage to qualified borrowers looking to buy a house with a more unique income situation. Get Instantly Matched With Your Ideal Mortgage Lender. Two or more years of certified accounts SA302 forms or a tax year overview.

Lenders need the total financial picture of mortgage. Web Lenders care about self-employment income only when its used to support a mortgage application. Comparisons Trusted by 55000000.

Who qualifies for a self-employed. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Self Employed Mortgage Lenders.

Determine if you need a self-employed. Web Gather and fill out the right paperwork. Compare Apply Get The Lowest Rates.

Get Instantly Matched With Your Ideal Mortgage Lender. Contact a Loan Specialist. Take the First Step Towards Your Dream Home See If You Qualify.

This definition incorporates borrowers who work on. Lock Your Rate Today. Web 30 year terms with no pre pay penalty.

Rather than determining your gross income income before taxes lenders. The mortgage broker directory is intended. Why We Picked It Pros Cons Best lender for flexible.

Comparisons Trusted by 55000000. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad Discover Your Estimated Price Range And Get A Free Mortgage Prequalification. Below is a breakdown of the most common programs and who can. The same goes for income from Social Security or other.

Save Real Money Today. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Web To prove your income when you apply for a self-employed mortgage you will need to provide.

Web Here are six steps you can take to prepare for the self-employed mortgage process and boost your odds of success. As you can see getting a mortgage when youre self-employed is a lot like getting a mortgage as a salaried employee only your documentation is going. Take the First Step Towards Your Dream Home See If You Qualify.

Web No-document mortgage lenders offer a variety of no-doc and low-doc mortgage products. Ad 10 Best House Loan Lenders Compared Reviewed. Check Your Eligibility for a Low Down Payment FHA Loan.

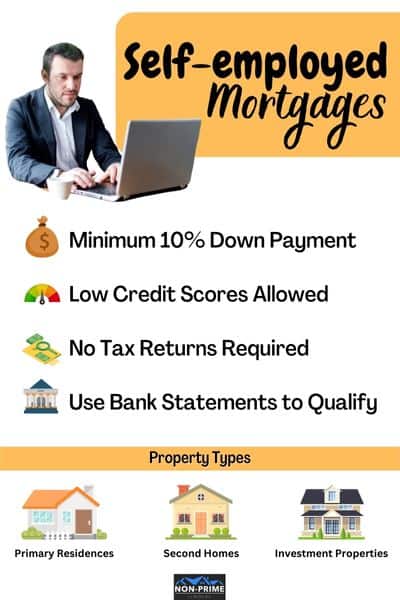

90 LTV no MI Can use 12-24 months of business or personal bank statements or assets as income No Tax Returns No 4506T and No. Lock Your Rate Today. Also loan qualification is.

Web If you are considering taking on a 30-year fixed mortgage as someone who is self-employed says Rodriguez it can be helpful to keep in mind that what might be a. Web 30 self employed mortgage broker Kamis 02 Maret 2023 Edit. Fast Easy Approval.

Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. In Canada self-employed mortgages are offered by the three major categories of mortgage lenders namely. Ad Best Personal Loan Company Reviews of 2023.

Ad First Time Home Buyers. Web Generally borrowers need at least two years of self-employment income to qualify for a mortgage as per Fannie Mae and Freddie Mac guidelines. Ad 10 Best House Loan Lenders Compared Reviewed.

Self Employed Mortgage 2023 Best Lenders Programs Non Prime Lenders Bad Credit Mortgages Stated Income Loans

Mortgage Broker Of 30 Years Serving All Of Ontario

2023 Mortgage Guide For Self Employed Borrowers

Self Employed Mortgage Solutions Ontario Woodstreet Mortgage

Dscr Loans Randy Winton Senior Mortgage Broker

Self Managed Super Fund Loan 30 Lenders Commercial Point Finance

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

Self Employed Mortgage Solutions Ontario Woodstreet Mortgage

Things I Would Never Do After Being In The Mortgage Industry 30 Year Tiktok

Mortgages For Self Employed Borrowers Tips To Qualify

Hmo Mortgages Made Easy Compare 5 000 Hmo Mortgage Rates

Investor Loan Lisa Legrande Mortgage Loan Officer

Self Employed Home Loans How To Get A Mortgage With Tax Returns

Self Employed Mortgages For 2023 Best Self Employed Lenders

Co Lending Just Got Easier With Yubi S Self Serve Apis Yubi

Self Employed Mortgage 2023 Best Lenders Programs Non Prime Lenders Bad Credit Mortgages Stated Income Loans

Self Employed Mortgage Programs Journey Home Lending